Le catene globali del valore promuovono l'integrazione attraverso gli accordi commerciali

|

| The Economics of Deep Trade Agreements, free ebook |

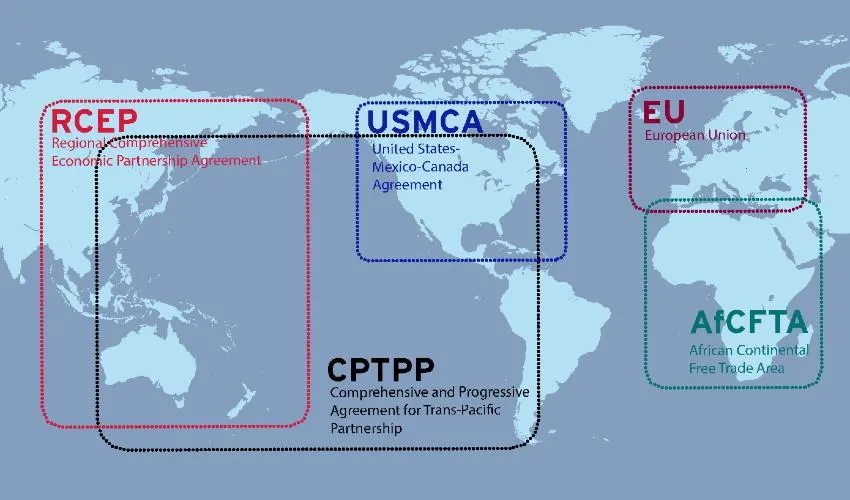

Gli accordi bilaterali e regionali sono stati i grandi vincitori nel mondo degli accordi commerciali negli ultimi 30 anni. Non è solo che si contavano 50 accordi regionali nel 1990 e se ne contano 300 oggi. Sono anche cresciuti in portata e ambizione: hanno esteso la loro portata ben oltre le tariffe, mirando a raggiungere un'integrazione oltre il commercio, o un'integrazione "profonda". The Economics of Deep Trade Agreements (un eBook del CEPR-World Bank, a cura di Ana Margarida Fernandes, Nadia Rocha, e Michele Ruta) raccoglie ricerche recenti sull'argomento e conclude che le regole e gli impegni contenuti nei Deep Trade Agreements (DTA) sono rilevanti per lo sviluppo economico, in quanto sono importanti determinanti dei modelli di commercio internazionale, dell'integrazione della catena del valore globale e del benessere. "Ciò che è chiaro è che una forte attenzione al contenuto dei DTA è essenziale per analisti e politici - il diavolo è nei dettagli", dicono i curatori. "Gli impegni e gli obblighi associati a questi accordi commerciali avranno conseguenze significative per l'economia mondiale". Due professori del Dipartimento di Scienze Sociali e Politiche della Bocconi, Carlo Altomonte e Italo Colantone, sono coautori del capitolo su "Global Value Chains and Deep Integration", che Bocconi Knowledge pubblica qui (nella versione originale in inglese), con piccole modifiche, per gentile concessione degli autori e dell'editore.

The post-1990 period has seen a proliferation of preferential trade agreements (PTAs). Some 700 PTAs are currently in force, compared to a little more than 100 PTAs before 1990. Both developed and developing countries have been and are deeply involved in preferential trade liberalization. While tariff reductions on a preferential basis are a central feature of all trade agreements, the inclusion of provisions that do not pertain directly to merchandise trade policies – e.g. provisions protecting foreign investment (FDI) and liberalizing access to markets for services – has become increasingly common in PTAs. As a result, many PTAs regulate trade-related issues more extensively and more stringently than the WTO. Simply put, preferential liberalization has become the main instrument of trade policy cooperation.

The academic literature in economics and international political economy has shown that the expansion of PTAs moves hand in hand with growth in FDI flows, offshoring, and global value chain (GVC) production. There is growing consensus that the activities of multinational enterprises, which splinter economic activity across countries, drive the formation of deep PTAs. Recent studies show that corporations involved in global production lobby in favor of deep PTA negotiations and outspend import competing industries to sway trade policy decisions.

There are several reasons why PTAs appeal to economic actors involved in GVCs. Preferential liberalization cuts tariffs on trade in intermediate goods between signatory countries, which is a core feature of GVCs. Trade in intermediates is often intra-firm trade, driven by vertical foreign direct investment, which makes investment provisions that protect multinational enterprises' assets in host markets a desirable feature of PTAs. PTA provisions that liberalize trade in services facilitate intra-firm movement of data, technology, and personnel. As important are effective dispute-settlement mechanisms that enhance the credibility of deep integration commitments, given that multinational enterprises face high risks of direct and indirect expropriation.

METHODOLOGY AND DATA

Empirical analysis has struggled to identify a clear-cut causal effect of GVC trade on the depth and design of PTAs. In a recent paper, we attempt to fill this gap using detailed information on the content of PTAs and measures of the GVC intensity of gross exports.

Empirically estimating the effect of trade on trade policy (in our case, the design/depth of PTAs) confronts a serious endogeneity problem as trade policy is very likely to have an effect on trade. Possible reverse causality makes identification of the causal impact of GVCs on PTA design a challenging task. In our paper, we propose a novel instrument for trade flows. The identification strategy exploits a recent transportation shock: the sharp increase in the maximum size of container ships, which has more than tripled during our sample period. The key variation in our instrument hinges on the fact that only deep-water ports can accommodate new larger ships and therefore, as larger ships become available, countries export relatively more towards partner countries that are more endowed with deep-water ports.

We construct our instrument by predicting trade flows from gravity estimations that include the interaction between the time-varying transportation shock (the maximum size of container ships), the country-level presence of deep-water ports, and bilateral exogenous dyadic variables such as geographical distance between two trading partners. Identification of the causal effect of trade on trade policy rests on the following assumption: conditional on controls and allowing for heterogeneity across country pairs based on bilateral characteristics, the variation in trade flows that is triggered by the presence of deep-water ports in partner countries – combined with the increase in the size of container ships – only affects trade policy formation through its effect on observed trade. Our strategy is flexible enough to generate excludable instruments for different value-added components of exports. This allows us to assess how the design of PTAs is affected by gross exports as well as by trade through GVCs, as captured by indicators of trade in domestic and foreign value added.

Armed with this identification strategy, we estimate the causal effects of gross exports and value-added trade on a synthetic indicator of PTA depth and on different dimensions of PTA design, including services liberalization, investment provisions, and the presence of binding dispute-settlement mechanisms. We build outcome variables capturing whether PTAs include 'WTO-PLUS' or 'WTO-EXTRA' provisions that go beyond what is regulated in WTO multilateral agreements. To build a broad and comprehensive portfolio of outcome variables, we merge two key datasets with information on the content of trade agreements: the DESTA database, which includes synthetic indicators of PTA depth, and the recent World Bank Deep Trade Agreements database, which contains information on a broader set of specific provisions in PTAs.

We focus on the pre-crisis period 1995–2007, which witnessed a rapid expansion of GVCs, and on the 40 countries covered by the World Input-Output Database from which we source the trade data for the analysis. Given this sample, the information used to construct our dependent variables comes from PTAs signed up to 2007, where at least two signatories belong to the sample of 40 countries included in the World Input-Output Database. These encompass 160 agreements in the DESTA database and 24 PTAs in the World Bank database.

RESULTS

We find that GVC trade and in particular the foreign value-added component of exports increases PTAs' depth. The size of our estimated causal effect is substantial. When we take our most conservative estimate, moving the foreign value-added component of bilateral exports in any sector by two standard deviations increases the level of depth in the bilateral trade policy relationship by 35% of the average depth in our sample. This effect roughly corresponds to going from the level of depth of the EC-Jordan Euro-Med Association Agreement (at the 67th percentile in the unconditional distribution of depth considering all agreements coded in DESTA) to that of the EC Europe Agreements with Estonia, Latvia and Lithuania (between the 78th and 81st percentile). These agreements have all been signed during the second half of the nineties but the difference between them is significant: Europe Agreements are notably very deep and comprehensive, as they pave the way for accession to the EU, while the EC-Jordan Association Agreement does not cover regulatory areas and does not address important issues such as government procurement nor introduce any significant level of commitment in services and investment liberalization.

Our results also show that trade and trade through GVCs have heterogeneous effects on the probability of including broadly identified chapters across different issue areas. However, we find that trade through GVCs systematically increases the probability that a number of narrowly defined 'WTO-PLUS' and 'WTO-EXTRA' provisions are included. These results provide empirical evidence that more intense GVC activities between two countries tend to increase the probability that deep PTA-based integration between them goes further than the WTO regime. Finally, we show that when looking at specific PTA provisions, the effect of GVC trade tends to be larger than the effect of gross exports, which also include activities unrelated to global production.

CONCLUSION

PTAs have become deeper and deeper over time, a trend that appeared for a while impossible to reverse or even to stop. However, our findings show that – for the period under analysis – this trend has been affected by the expansion of GVCs. Protectionist policies implemented by populist parties and the COVID-19 pandemic are likely to contract GVCs, at least for the near future. If this is the case, the GVC-related incentives to design deep trade cooperation might be reduced in the next stage of globalization.