If Caesar Had Been a Frontline Manager

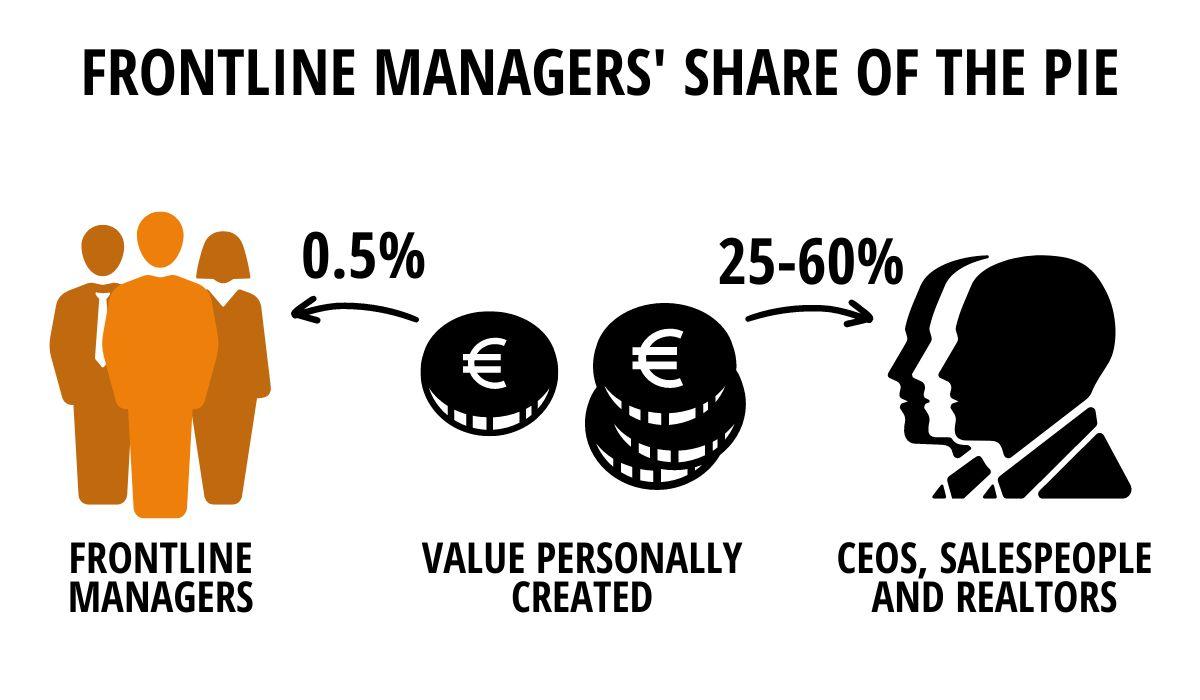

Frontline managers' pay does not reflect their personal contribution to a firm's profits. They capture only 0.5% of the value created, as opposed to 25-60% for more visible occupations such as CEOs, salespeople and realtors, according to a recent study by Arnaldo Camuffo (Bocconi Department of Management and Technology) joint with Federica De Stefano (HEC Paris) and Matthew Bidwell (Wharton).

Infographic by Weiwei Chen

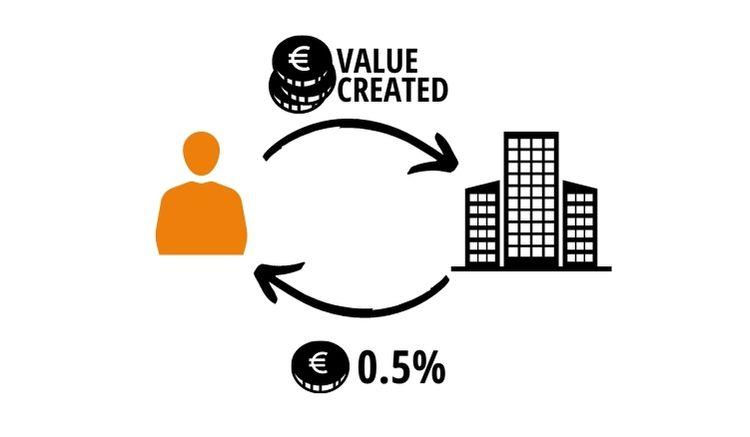

"Employers struggle to identify individual contributions to value creation," Professor Camuffo explained. "They are often unaware of how much more value is created by the highest-performing managers and, consequently, are not prepared to share much value with them during bargaining."

Frontline managers, for their part, face similar challenges in disentangling the value of their own contribution and, in any case, their bargaining power is partly hampered by lack of alternative employment opportunities.

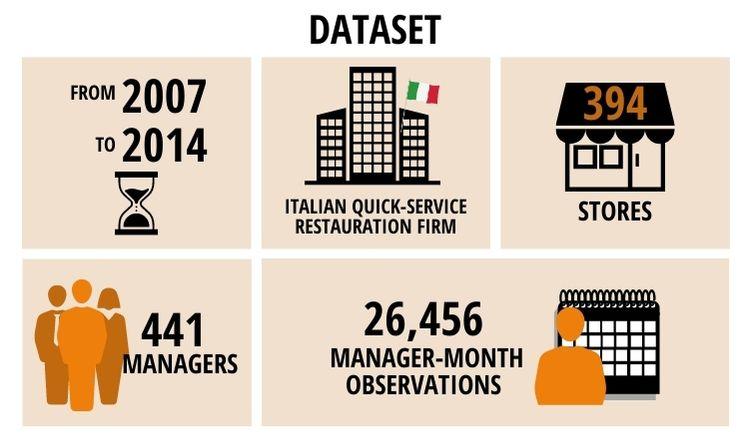

The authors analyzed an Italian quick-service restauration firm and had access to a matched store-employee dataset with monthly personnel records for all store managers for the years 2007–2014. After some refinement, the final database included 441 managers and 394 stores (26,456 manager-month observations).

Prof. Camuffo and his colleagues were able to separate out the contribution to profitability of different managers from store-level influences by exploiting a corporate policy which regularly rotates managers. An average of 23% of managers changed stores each year during the observation period.

They found that the highest-performing managers were able to capture only 0.5% of the value created.

Their analysis suggested that firms may frequently confuse unit-level determinants of performance with the managers' own contributions, evaluating and rewarding managers on the basis of unit characteristics rather than their individual contributions. "In many firms both bonuses and performance appraisals are much more closely related to the unit performance than to any persistent differences in the manager's individual performance," Prof. Camuffo said.

The variation in manager pay was around 11 times smaller than the variation in manager performance Nevertheless, voluntary turnover was extremely low, with only 25 exits in eight years. Simply put: the firm was able to avoid sharing value with the best employees with no prejudice to its financial sustainability.

"An improvement in firms' ability to value personal contributions, however, would probably translate into enhanced profitability through better capacity to allocate frontline managers across units, and thus into increased willingness to share the value created," Prof. Camuffo concluded.

Federica De Stefano, Matthew Bidwell, Arnaldo Camuffo, "Do Managers Capture the Value They Create? Drivers of Managers' Value Capture in a Large Retail Chain." Strategic Management Journal, Vol. 43, Issue 10, Pages 1983-2011. DOI: https://doi.org/10.1002/smj.3401.