Financial Reporting Is More Reliable if a Firm Is Named After Its Founder

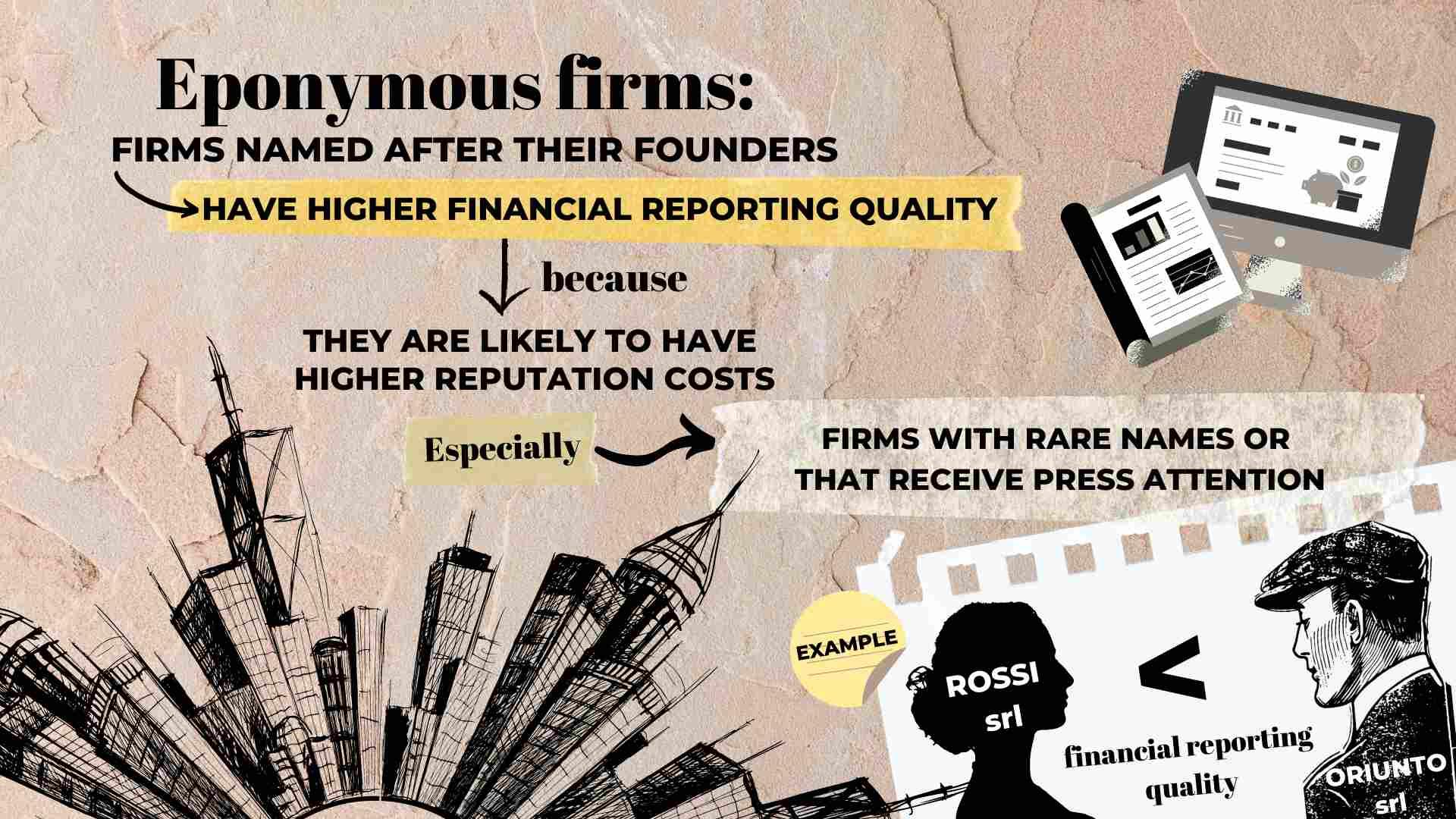

We can expect better financial reporting quality from private firms named after their founders (eponymous firms) than from other firms, according to a study recently published in Management Science. "Because of the link between the individual's name and the firm's name, the owners/managers of eponymous firms are likely to be more affected, both financially and non-financially, by the firms' reputation," said Bocconi Professors Alessandro Minichilli (Department of Management and Technology) and Annalisa Prencipe (Department of Accounting). "To build and sustain the firms' reputation, eponymous firms are more likely to emphasize accountability, credibility, and trustworthiness into their corporate culture, thus leading to more reliable reports, more cooperation with auditors, and better financial reporting quality".

The research team, including Suresh Radhakrishnan (University of Texas at Dallas) and Gianfranco Siciliano (China Europe International Business School), observed that the positive association between eponymy and financial reporting quality is stronger in eponymous firms that have rarer names or receive more press attention.

Infographics by Weiwei Chen

The Italian setting is excellent for examining name rarity, because with 0.35 million last names, Italy has the largest variety of last names in the world. Furthermore, Italian private limited liability enterprises (SPAs and SRLs) have audited financial statements aimed at reducing the possibility that an enterprise engages in business dealings in which the owners/managers take advantage of the limited liability and defraud outside stakeholders. This should incentivize private firms to institute good financial reporting quality so as to protect their private wealth and reputation.

Eponymous firms have higher reputational concerns because of the ease of identifying the owners/managers with the firm. Therefore, those with rare names or more visible in the press are likely to have higher reputation costs.

More interestingly, the positive association between financial reporting quality and eponymy is similar whether the top executives/board members belong to the founding family's first or later generations.

The findings collectively indicate that reputation concerns act as a disciplining mechanism for financial reporting quality in private firms.

Alessandro Minichilli, Annalisa Prencipe, Suresh Radhakrishnan, Gianfranco Siciliano, "What's in a Name? Eponymous Private Firms and Financial reporting Quality.", Management Science, Ahead of Print. DOI: https://doi.org/10.1287/mnsc.2021.3974.