The Economics of COVID Resilience

After a very tough first half of 2020, share prices of non-financial companies listed on the Italian Stock Exchange have returned to the same values as at the beginning of the year. However, Covid has left deep scars on financial statements, according to an analysis of the annual reports of 273 companies listed in Milan (equivalent to almost the entire market capitalization of non-financial companies). The study was conducted by the KPMG Chair in Accounting at Bocconi and signed by the Chair holder, Annalisa Prencipe, with Antonio Marra.

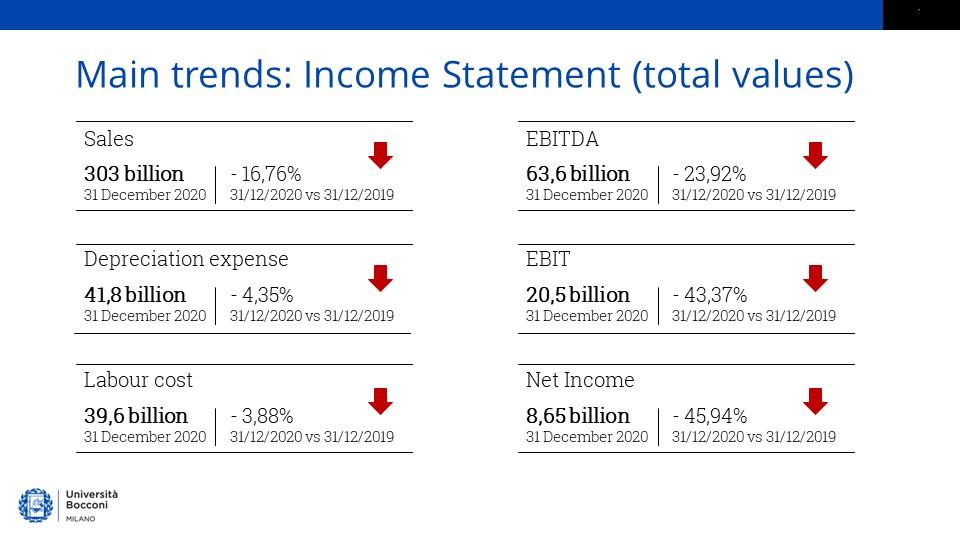

Total 2020 sales were 16.8% lower than in 2019 (mid-year decline was more than 20%), while earnings before interest and taxes (EBIT) and net income plummeted around 45%.

In such an environment, profitability suffered. The average return on equity (ROE) became negative (-3.29% compared to 2.48% in 2019), while the average return on assets (ROA) more than halved, from 3.77% in 2019 to 1.64% in 2020.

Confirming the sharp reduction in business operations, aggregate net operating working capital declined by more than 10%. Government measures, though, proved effective. Through the work compensation scheme, they reduced the cost of labor per employee by 5.6% for the same number of employees, while through public guarantee, they reduced the average cost of debt from 4.8% to 4.2%.

"However, the consequences of the crisis were not felt homogeneously," Professor Prencipe says, "and some companies proved more resilient."

Differences between sectors were expected: Technology, Medical&Pharma and Environment & Green Mobility even posted small increases in EBITDA, while Transportation, Fashion&Luxury and Entertainment&Leisure saw it plunge between 38% and 51%.

Less expected, however, are the differences in terms of company size. "If, in the first half of the year, medium-sized companies fared better," Professor Prencipe explains, "considering the whole of 2020, it is large companies that came out better, thanks to the greater possibility of mobilizing resources." Resilience was also aided by the availability of cash before the start of the pandemic.

Finally, family-controlled businesses performed better, "probably because, in a time of crisis, ownership that is more concentrated and closer to management allows for greater responsiveness."