Corporate Codes of Conduct Go Beyond Impression Marketing

Corporate rulebooks on corruption are not just do-good propaganda, as a new paper written by Francesco Grossetti and Miles Gietzmann of Bocconi's Department of Accounting together with Olga Bogachek of the Free University of Bolzano-Bozen finds.

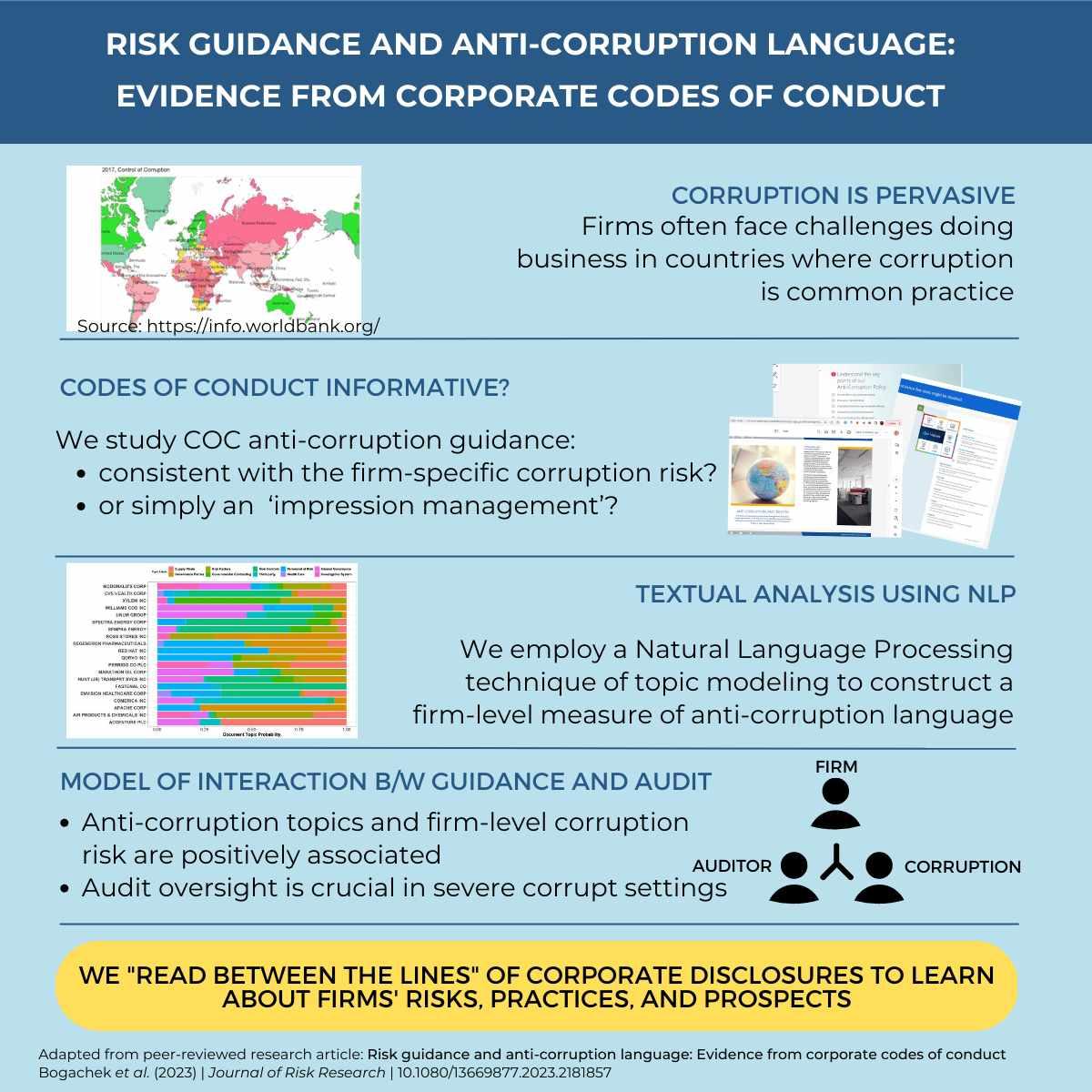

Though companies are expected to commit themselves to act transparently and to conform to a healthy business culture, it is easy to dismiss big firms' declarations of principle, and in particular their Codes of Conduct (CoC) against bribery and corruption, as little more than window-washing. Documents, that is, that companies might produce to conjure a pretense of responsibility and honesty which sounds serious but is ultimately meaningless. A practice so widespread that the name "impression marketing" has been coined to describe it. But is this really the case?

The authors tried to investigate the matter using advanced machine learning technology. They fed into a computer model a significant number of CoC documents issued by as many S&P 500 companies in an attempt to detect what concepts were most often recurring within them. This analysis is called "topic modeling" and the output is in effect word clusters, based on statistically frequent associations.

Infographic by Olga Bogachek

Companies, crucially, operate in different environments with varying levels of exposure to the risk of corruption, and this might be reflected in their CoC's. For this reason, every company was given a rating based on the World Bank Control of Corruption Index.

The first result is that these documents appear to be original, and not copied from each other. More importantly, there is a positive correlation between anti-corruption topics and the assessed firm-adjusted level of corruption risk. In other words, the language used varies depending upon the corruption risk faced by each company. This result suggests that CoC's are not simply used for impression management: corporations are aware of the corruption risks they face and use a suitably strong anti-corruption language.

Further evidence of actual commitment is the fact that when corruption risk is higher, corporate anti-corruption communication tends to stress the importance of external audits. "Our results confirm that one can indeed read between the lines of corporate declarations," says Francesco Grossetti. "Corruption risk disclosures are informative to investors and textual analysis can provide insights into a firm's risk management practices. Our study may open new avenues for auditors who may care about the information content of CoC when evaluating a firm's risk practices."

Olga Bogachek, Francesco Grossetti, Miles Gietzmann, "Risk guidance and anti-corruption language: evidence from corporate codes of conduct", Journal of Risk Research, published online 17 March 2023, DOI https://doi.org/10.1080/13669877.2023.2181857