Circular Businesses Risk Less and Reap Higher Returns

Thanks to the circular economy we can reduce the 45% of greenhouse gas emissions that cannot be eliminated with the adoption of renewable sources, thus combating climate change, loss of biodiversity and pollution. The circular economy is based, in fact, on the three principles of eliminating waste and pollution, keeping products and materials in use, and regenerating natural systems.

Advantages of a financial nature can follow, according to the white paper Circular Economy. A De-Risking Strategy and Driver of Superior Risk-Adjusted Returns, published today by Università Bocconi, Ellen MacArthur Foundation and Intesa Sanpaolo.

Advantages of a financial nature can follow, according to the white paper Circular Economy. A De-Risking Strategy and Driver of Superior Risk-Adjusted Returns, published today by Università Bocconi, Ellen MacArthur Foundation and Intesa Sanpaolo.

The analysis of 222 listed companies in Europe, active in 14 different sectors, shows that the adoption of the principles of circular economy significantly reduces the risk of default of a company and, for the same market risk, provides better stock returns.

The researchers, led by Claudio Zara of GREEN (Centre for Research on Geography, Resources, Environment, Energy & Networks at Bocconi University), developed a Circularity Score based on data and information available in financial databases, and through a new methodology are thus able to assign a score to the circularity of each company. The Circularity Score can be used to investigate the relationships with the main financial performance variables, such as the risk of default at one and five years and the risk-adjusted return.

"To arrive at a reliable measure of business circularity," Professor Zara explains, "we analyzed 19 methodological proposals advanced in the literature so far, none of which was able to assign a continuous score to a business entity that was both economic and material."

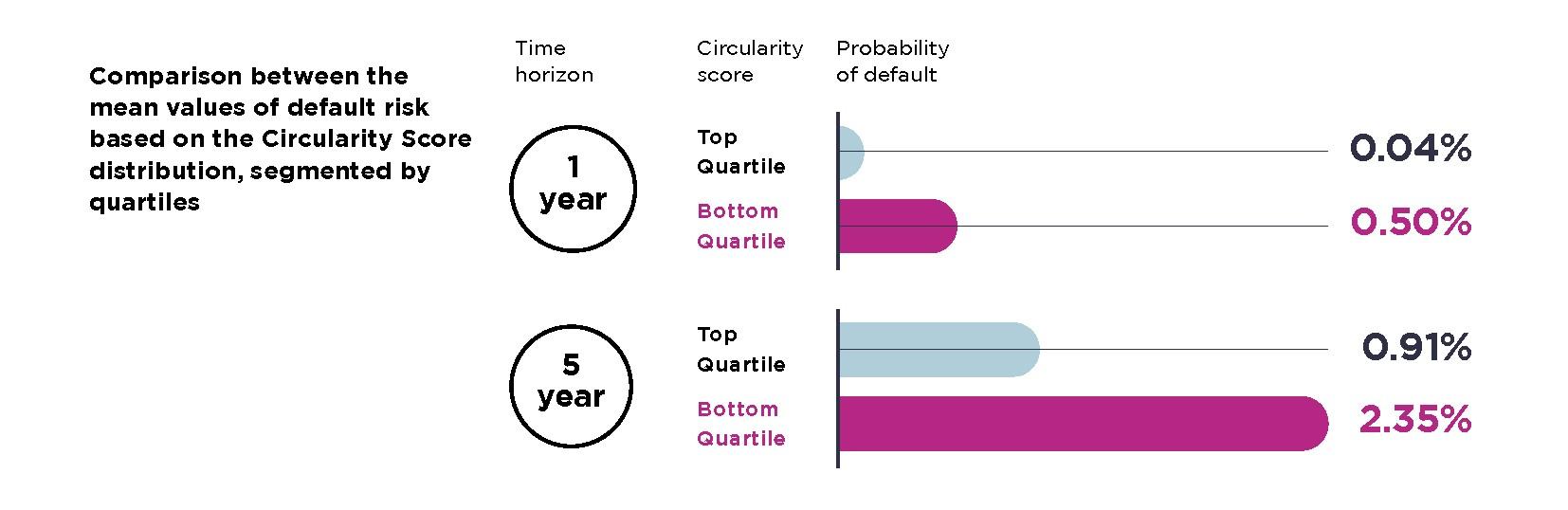

The effect of circularity is evident by comparing the results of the 25% of companies with the highest Circularity Score (the most circular) and the 25% with the lowest Circularity Score (the least circular).

The one-year risk of default increases more than 12-fold, from 0.04% for the most circular firms to 0.5% for those with the lowest Circularity Score. The 5-year default risk increases from 0.91% to 2.35%.

As for financial performance adjusted for its systematic risk, the indicator that measures it (the Treynor Ratio) goes from 0.22 for the most circular firms to -0.73 for those that are less circular.

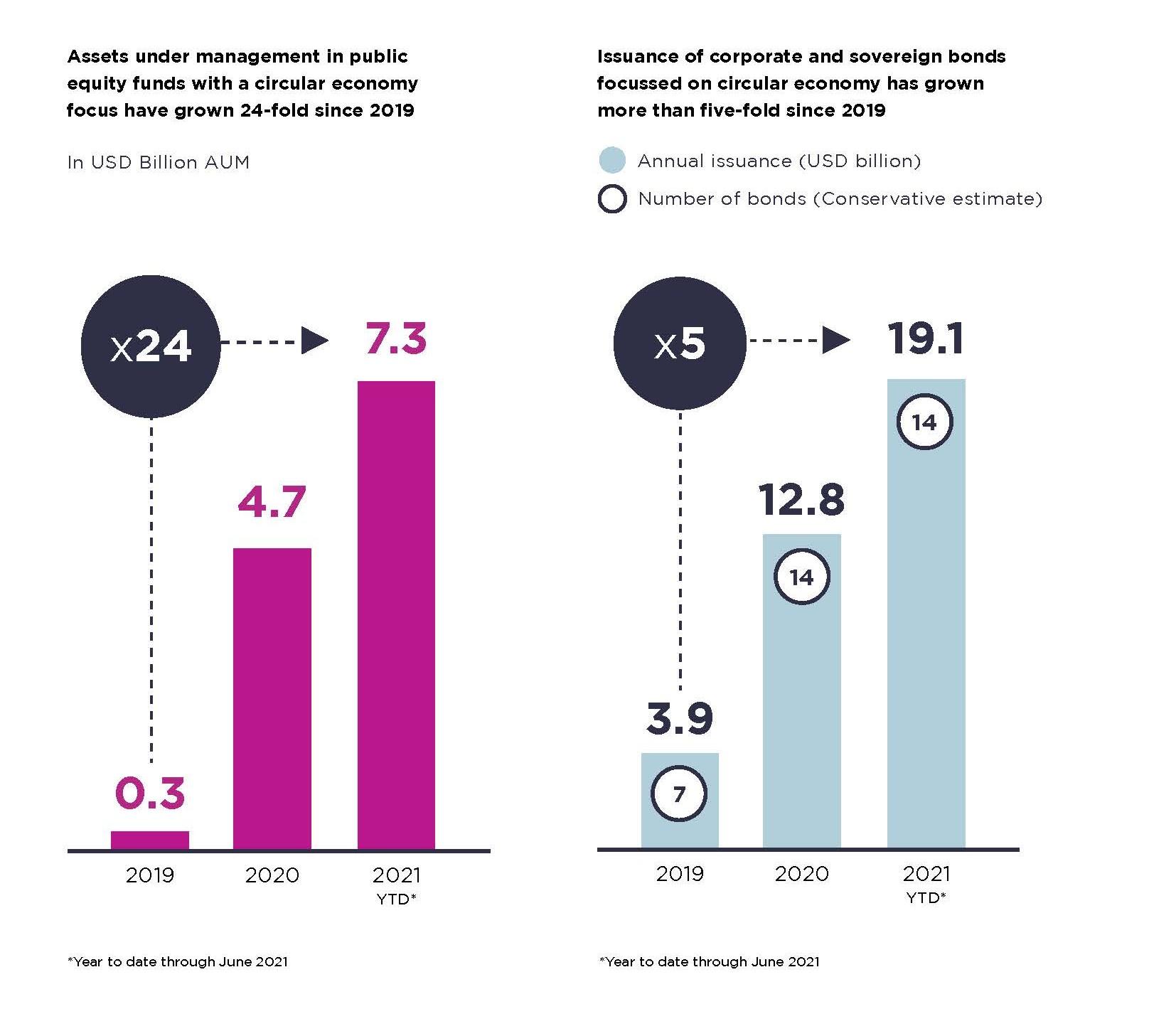

The attractiveness, in financial terms, of circularity is confirmed by market trends. The number of investment funds dedicated to the circular economy increased from 2 in 2018 to 13 in 2021, and assets under management rose from $0.3bn in December 2019 to $7.3bn in May 2021, increasing 24-fold. Since December 2019, at least 35 sovereign or corporate bonds related to the circular economy have been issued.

Scholars are also beginning to observe preliminary evidence of improved performance and resilience of circular economy assets. In the first half of 2020, circular investment funds performed 5% higher than Morningstar's category benchmarks. As an example of a methodology of analysis that can be applied to many sectors and companies, the researchers, comparing two otherwise similar bond issues, observed that, in the face of the crisis caused by COVID, the one linked to the circular economy lost less value and recovered more quickly when markets began to turn. This evidence is also found in the other analyses conducted by the research team.

The final chapter of the white paper describes how an international bank such as Intesa Sanpaolo is concretely using the results of academic research to guide its activities in the field of sustainability and circularity.