The Capital of Large Italian Companies, 30% Controlled by Women, Ensures Better Governance

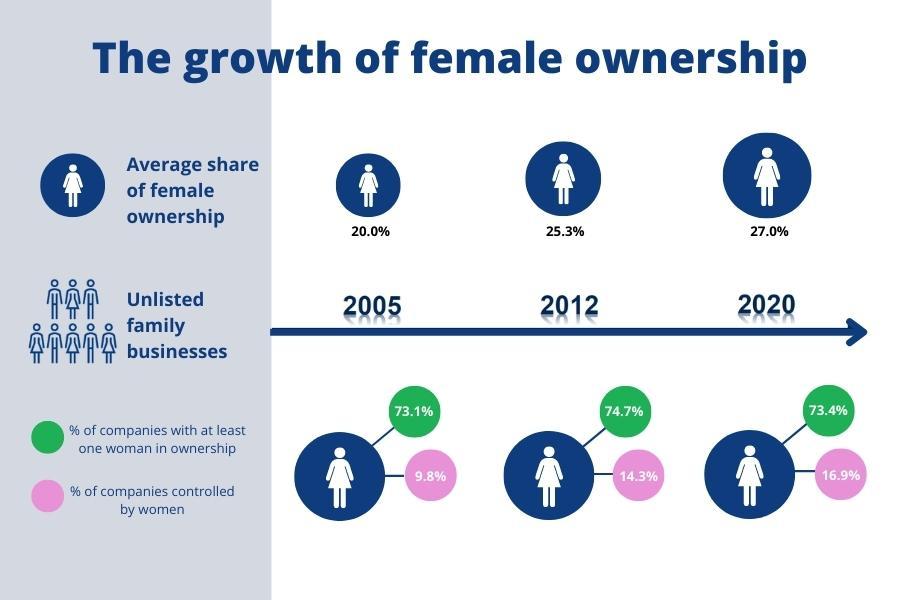

Women's share in Italian family-owned industrial groups with turnover over 100 million is 27.1 percent, which while still far from parity shows a marked increase over time having risen by about a third in the last 15 years. The figure is lower in listed family businesses, where the cumulative female presence in capital goes no further than 20.4 percent.

These are some of the results of research coordinated by Alessandro Minichilli, director of the Corporate Governance Lab at SDA Bocconi School of Management, and conducted in collaboration with Lazard and Linklaters. The researchers were able to collect information on 1094 unlisted Italian family businesses with revenues over €100m and 221 listed ones – both on the Euronext and Euronext Growth markets (a sample exceeding 95 percent of the relevant total) – over the period from 2005 to 2020.

Based on the historical data reconstructed in this way, the study also estimated a projection of female ownership over the next 10 and 20 years. Assuming that gender inequality is an outdated factor in business culture, and estimating the number of ownership successions that are likely to occur in these time windows, one can imagine a substantial narrowing of the gender gap in ownership that could result in women owning an average of 37.1 percent of the capital of the companies considered in 2030, and 44.5 percent in 2040.

However, female-dominated firms have some special features. First, there is a strong trickle-down effect between female ownership and the choice of women as CEOs: they range from 10 percent of female CEOs in fully male-owned firms to 41 percent in firms where female ownership exceeds 50 percent. Women-controlled firms also have on average better governance than those with only male ownership and are more frequently run by CEOs from outside the controlling families. In particular, the Corporate Governance Index (CGI), which measures the quality of the top management structure of firms, is significantly higher (2.56 versus 2.32, which corresponds to a 10% difference) when women are controlling shareholders, and outside CEOs rise from 30.3% in male-controlled firms to 37.8% in female-controlled firms. In addition, women-controlled firms grow more and are less indebted.

The strategic choices of female-controlled firms are also notable: although the M&A deals they complete are fewer in number, they are higher value deals and more open to foreign partners. Overseas presence also follows a significantly different strategy: "Women-controlled firms have, on average, more subsidiaries abroad. In addition," Professor Minichilli explains, "they show a greater degree of diversification in the geographic distribution of foreign affiliates."

"A surprising fact that emerges from the research is that almost a third of the capital of large Italian companies is now controlled by female shareholders and that in twenty years we will reach just under half"" comments Michele Marocchino, Managing Partner Lazard. "This is an important piece of evidence for its newness and its impact on the business system and we thinkit could lead to a virtuous change within companies both in terms of governance and strategic choices."

"If the predictions regarding the evolution of female ownership that emerged from the study are confirmed," comments Claudia Parzani, Partner Linklaters and President Borsa Italiana, "we will have an enrichment of the system thanks to more open and collaborative governance models, heterogeneity of skills and renewed leadership styles. New tools and solutions, different experiences and skills will help companies face the most complex challenges and seize all the related opportunities."